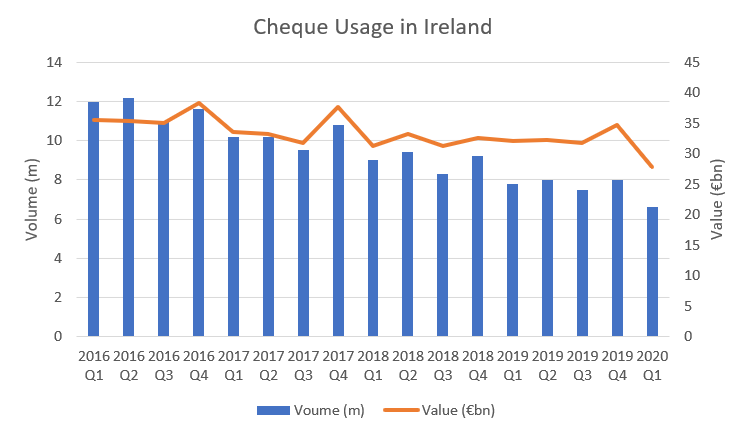

Some 6.6 million cheque payments in Q1 2020, down 15% on same period last year and down 45% since 2016

The latest figures from Banking & Payments Federation Ireland (BPFI) show that cheque usage continued to decline in Q1 2020 with only 6.6 million cheque payments, down from 7.8 million (-15%) in Q1 2019 and 12 million (-45%)in the first quarter of 2016[1].

Cheque usage has declined in recent years as both business and consumers move to electronic payments. Consumers, in particular, rely heavily on cards to pay for their shopping both online and in the store, while they mainly use direct debits to pay their regular bills such as electricity, TV or phone.

A recent consumer survey commissioned by BPFI[2] showed that only 2% of consumers prefer to pay a bill or a friend by cheque while only 4% prefer to donate to charity by cheque.

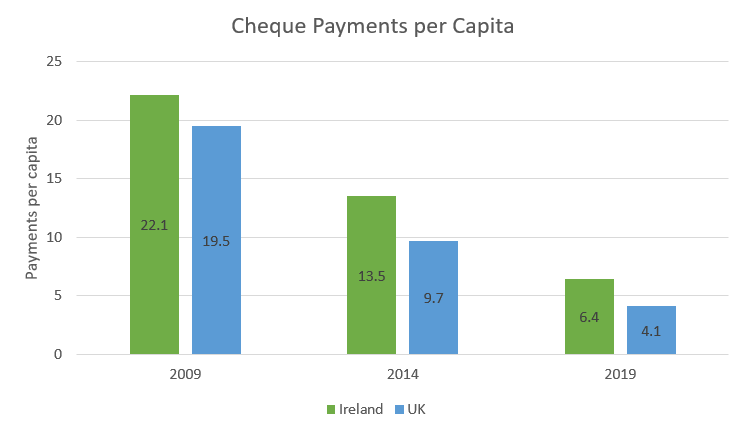

Ireland is now one of only a handful of countries worldwide where cheques are still regularly used, including Canada, Cyprus, France, Portugal, Singapore, the UK and the US, based on figures from the European Central Bank and the Bank for International Settlements. Both Ireland and the UK have seen substantial falls in cheque usage in the past decade, with Irish cheque usage per capita down from 22.1 in 2009 to 6.4 in 2019.

Speaking about today’s figures, Gill Murphy, Head of Payment Schemes, BPFI said: “Given the fast-changing nature of consumer preferences away from cheques and towards electronic transfers, cards and mobile banking, today’s figures are not a surprise. This continued drop in cheque usage by consumers is a trend we expect to see continue as consumers and businesses are provided with more choice and convenience regarding payment methods. At the same time however 6.6 million cheque payments this quarter is not insignificant and demonstrates that some consumers and smaller businesses in particular are still in no rush to shred their chequebooks just yet, the challenge for us is to try to ensure that there is a full awareness of what the alternative options are and the potential benefits of those options for both consumers and businesses.”

Contact: Jillian Heffernan, Head of Communications, 087 9016880 or jillian.heffernan@bpfi.ie

Notes: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland, and the Fintech & Payments Association of Ireland, BPFI has some 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

[1] BPFI’s current quarterly data series on cheques starts in Q1 2016

[2] Banking & Payments Federation Ireland: Consumer Payments Research Report May 2020