More than €63m worth of contactless per day in Q2 2020

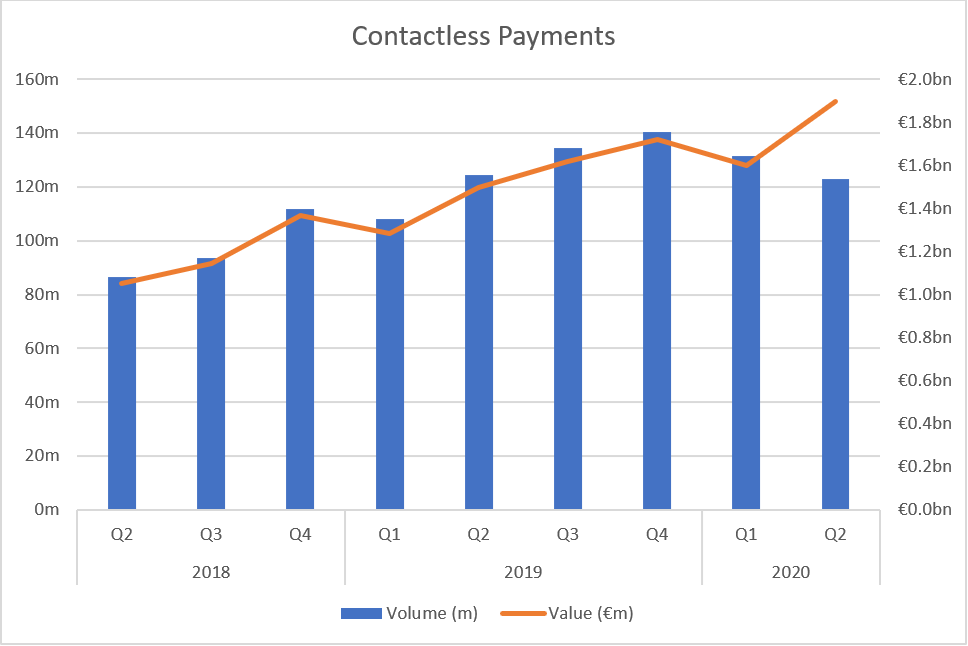

The latest figures from Banking & Payments Federation Ireland (BPFI) show that the value of contactless payments reached a new high of almost €1.9 billion in Q2 2020, some 26.6 % higher than in Q2 2019. Spending grew despite volumes dipping to 123 million, the lowest level since Q1 2019, and 1% lower than a year earlier.

Consumers increased their use of contactless payments as cash usage fell and with the contactless limit increasing to €50 during April in response to the COVID-19 crisis, the average payment value jumped from €12.51 in March to €15.57 in June.

Daily contactless spend reached a new monthly high of €27.7 million in June, having dropped as low as €15.7 million in April.

Speaking on the latest figures, Brian Hayes, BPFI Chief Executive said: “Now more than ever consumers want fast, simple and secure payments and this is reflected in today’s figures which show strong Q2 growth in the value of contactless payments. It is likely this growth is in part a result of the increase in the contactless limit to €50, a significant undertaking at the time by BPFI members who worked hard deliver this in collaboration with a number of parties.”

“The increase in contactless payments reflects a wider recovery in the economy, and in the retail and hospitality sectors in particular. We would expect contactless payments to continue to grow in the months ahead in line with consumer spending.”

Contact: Russell Bryce, Head of Public Policy Engagement and Research, 0851019444 or russell.bryce@bpfi.ie

Notes: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland, and the Fintech & Payments Association of Ireland, BPFI has some 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

Source: BPFI. Data is collected from AIB, Avantcard, Bank of Ireland, KBC Bank Ireland, permanent tsb and Ulster Bank. It includes payments by card and mobile wallet such as Apple Pay or Google Pay