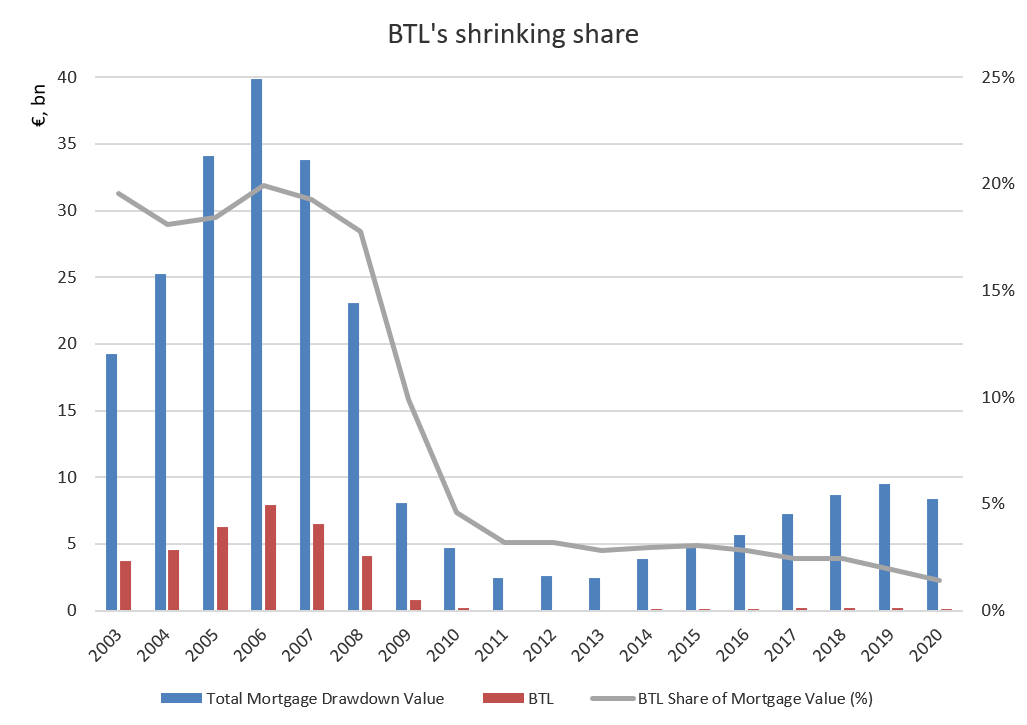

Significant decline in buy-to-let investors in housing market with BTL loans now accounting for less than 1% of mortgages compared to 20% in 2006

Supply-demand imbalance in the housing market set to continue in 2021 as COVID-19 limits housing supply while demand remains strong

- A total of 35,617 mortgages to a value of €8.4 billion drawn down in 2020

- A total of 43,151 mortgages to the value of €10.3 billion approved in 2020

Tuesday 9th March 2021 – The latest Housing Market Monitor Q4 2020 published today by Banking & Payments Federation Ireland (BPFI) shows that as the role of individual Buy-to-Let investors continues to decline, accounting for less than 1% of total mortgage drawdowns in 2020, non-household buyers, including private companies, charitable organisations, and state institutions, now account for 23% of all market transactions.

Providing his analysis of the housing market, Brian Hayes, Chief Executive, BPFI further outlines that the supply-demand imbalance in the housing market will continue in 2021 as COVID-19 limits housing supply while demand remains strong especially among households less affected by the pandemic and non-household investors.

Commenting on his latest assessment of the market Mr Hayes said: “Covid-19 has had a significant negative impact on the Irish housing and mortgage markets in 2020, however demand remains strong especially among households less affected by the pandemic and non-household investors.

“Interestingly, our most recent analysis shows a significant decline in the role of individual buy-to-let (BTL) investors in the market in recent years. At the peak of the mortgage activity in 2006, BTL loans accounted for around 20% of total mortgage drawdowns compared to less than 1% in 2020. At the same time, there has been a marked increase in the role of non-household buyers which includes private companies, charitable organisations, and state institutions who now account for 23% of all market transactions, up from 3% in 2010.”

Supply-demand imbalance

Evaluating the likely impact of COVID-19 on housing supply and demand, Mr Hayes explains that while demand for housing remains strong, there is continued uncertainty around housing supply due to reduced capacity and output in construction caused by Level 5 restriction so far this year:

“The pandemic will continue to have a negative impact on housing completions in 2021 because construction activity is not expected to fully start again until April 2021, at the earliest, assuming public health developments remain positive. However, the sector has gained more experience in terms of increasing output after the first lockdown last year, hence we expect completion numbers in 2021 to be at least similar to levels observed in 2020 at around 21,000 units.

On the demand side, the number of employees on some sort of state support increased significantly in early 2021 due to tightened strict public health measures, yet income tax revenue continued to show resilience. January 2021 income tax receipts were up by 3.9% compared with January 2020 which shows that earnings are not affected in sectors where employees are able to continue to work from home or in businesses categorised as essential and continuing to operate.

Given supply disruptions in the residential construction sector in the first quarter of 2021 and the expected continued demand for housing from certain cohorts of income earners as well as the non-household sector, it is likely that the supply-demand imbalance in the Irish housing market will continue during 2021.”

Mortgage lending recovery

The monitor also highlights that lenders continued to support the residential mortgage market in terms of mortgage market activity in 2020 with BPFI mortgage data showing that there were 35,617 mortgage drawdowns valued at €8.4 billion in 2020 and 43,151 mortgage approvals in the same period with the total value reaching €10.3 billion. Notably nearly 44% of total mortgage approvals in 2020 took place in the last four months of the year, which is a significant potential pipeline of activity in terms of drawdowns in early 2021. The latest mortgage approvals figures show continued year-on-year growth in January 2021, rising by 2.8% compared with the same period last year, reaching €823 million.

Notes: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland and the Fintech & Payments Association of Ireland, BPFI has some 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

The BPFI Housing Marking Monitor is published quarterly. In addition to presenting a unique range of loan-level data, the Monitor draws on a range of published data under the three key headings of housing supply, housing prices and rents, and housing transactions in its assessment of the current state of the housing market.

Contact: Jillian Heffernan, Head of Communications, 087 9016880 or jillian.heffernan@bpfi.ie