Lower costs and better coordination needed to deliver affordable housing

Increasing supply still lags demand

Cost factors in new building should be addressed

The latest Housing Market Monitor Q4 2019 published today by Banking & Payments Federation Ireland (BPFI) shows that, even as housing supply increases, substantial affordability issues remain that should be addressed by reducing prices as well as enhancing households’ capacity to borrow. The Monitor also points to increased activity across key indicators including housing supply and mortgage activity.

Drawing on BPFI data as well as a range of other published research for its assessment of the current state of the housing market, the latest BPFI Housing Market Monitor draws attention to some key findings as follows:

- Housing supply in Ireland increased from around 5,000 units in 2012 to over 21,000 units by the end of 2019 and is likely to reach around 25,000 units by the end of 2020.

- Planning permissions data show that there is a robust pipeline of new activity with more than 30,000 estimated units granted planning permission in 2019.

- Irish mortgage activity continued to grow in 2019, with approvals up 9% to 49,000 and drawdowns up 4% to almost 43,000. Much of the growth was driven by first-time buyers (FTBs) who accounted for around 51% of the value of mortgage drawdowns in 2018, up from 21% in 2006 when drawdown activity was at its peak.

Commenting on the latest trends, Dr Ali Uğur, Chief Economist, BPFI, explains that despite substantial increases in housing prices in recent years and some positive signs in relation to housebuilding, supply has not responded as hoped. This pattern has been replicated in other markets.

“Basic laws of supply and demand in economics show that, when housing demand outpaces supply, prices go up. In theory supply should increase in response to that demand and prices stop increasing. At a global level the housing market has not followed this pattern in many countries where rents and housing prices have risen but supply has not rebounded to the levels required.”

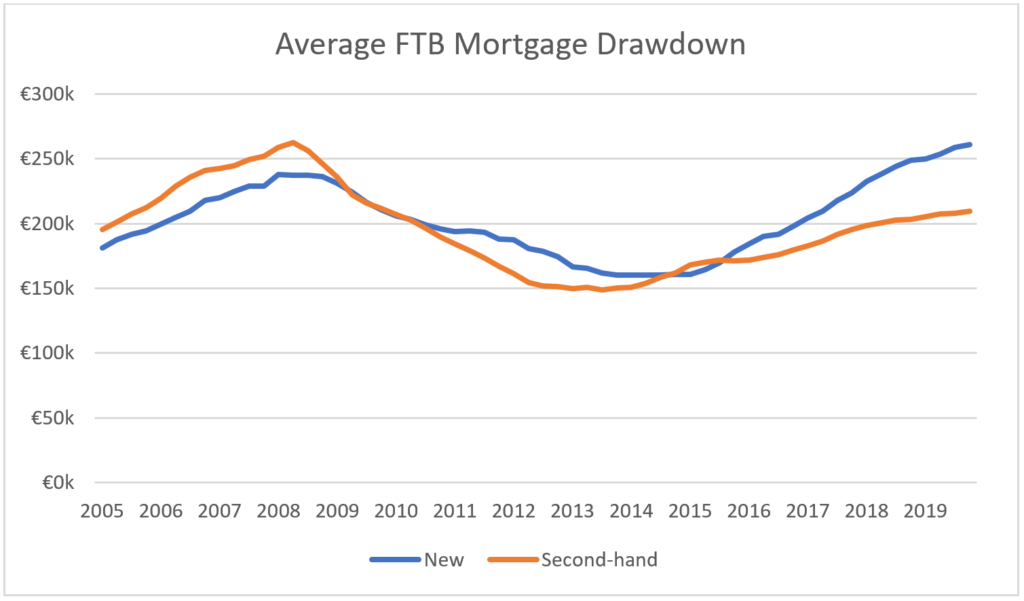

Growing housing supply seems to be bringing some stability to residential property prices but evidence from mortgage data suggest that FTBs are paying much higher prices, on average, for new properties than for second-hand properties. The average mortgage drawdown value for an FTB buying a new property was more than €261,000 in Q4 2019, almost €52,000 more than the average FTB drawdown on second-hand properties. This contrasted with the pattern in the peak lending period of up to 2008, when the average FTB drawdown for a second-hand property was higher than that for a new property.

Dr Uğur highlights the cost factors that feed into new home prices:

“Property sector data show that land and development costs account for around 55% of house prices in Ireland where cost inflation in relation to labour and materials only seem to be showing upward pressure in the past 18 months. At the same time, there seems to have been

a significant increase in costs in relation to regulation and infrastructure service provision. While we are building more homes in order to try meet required demand, it is critical that we should address some of the cost challenges where possible, so that lower costs can feed into lower prices and better affordability for potential homebuyers. We also need to see better coordination at policy level within various national and local government bodies as well as a rethink of our current planning approach to density.”

The BPFI Housing Market Monitor is available on the BPFI website here.

Notes: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland and the Fintech & Payments Association of Ireland, BPFI has some 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

The BPFI Housing Marking Monitor is published quarterly. In addition to presenting a unique range of loan-level data, the Monitor draws on a range of published data under the three key headings of housing supply, housing prices and rents, and housing transactions in its assessment of the current state of the housing market.

Contact: Jillian Heffernan, Head of Communications, 087 9016880 or jillian.heffernan@bpfi.ie