The latest Housing Market Monitor Q2 2019 published today by Banking & Payments Federation Ireland (BPFI) shows that, as average housing prices move ever closer to the peak of the previous cycle, the pressure on household incomes to meet the cost of accommodation is ever increasing.

Drawing on BPFI’s unique loan-level data as well as a range of published data for its assessment of the current state of the housing market, the latest BPFI Housing Market Monitor draws attention to some key findings as follows:

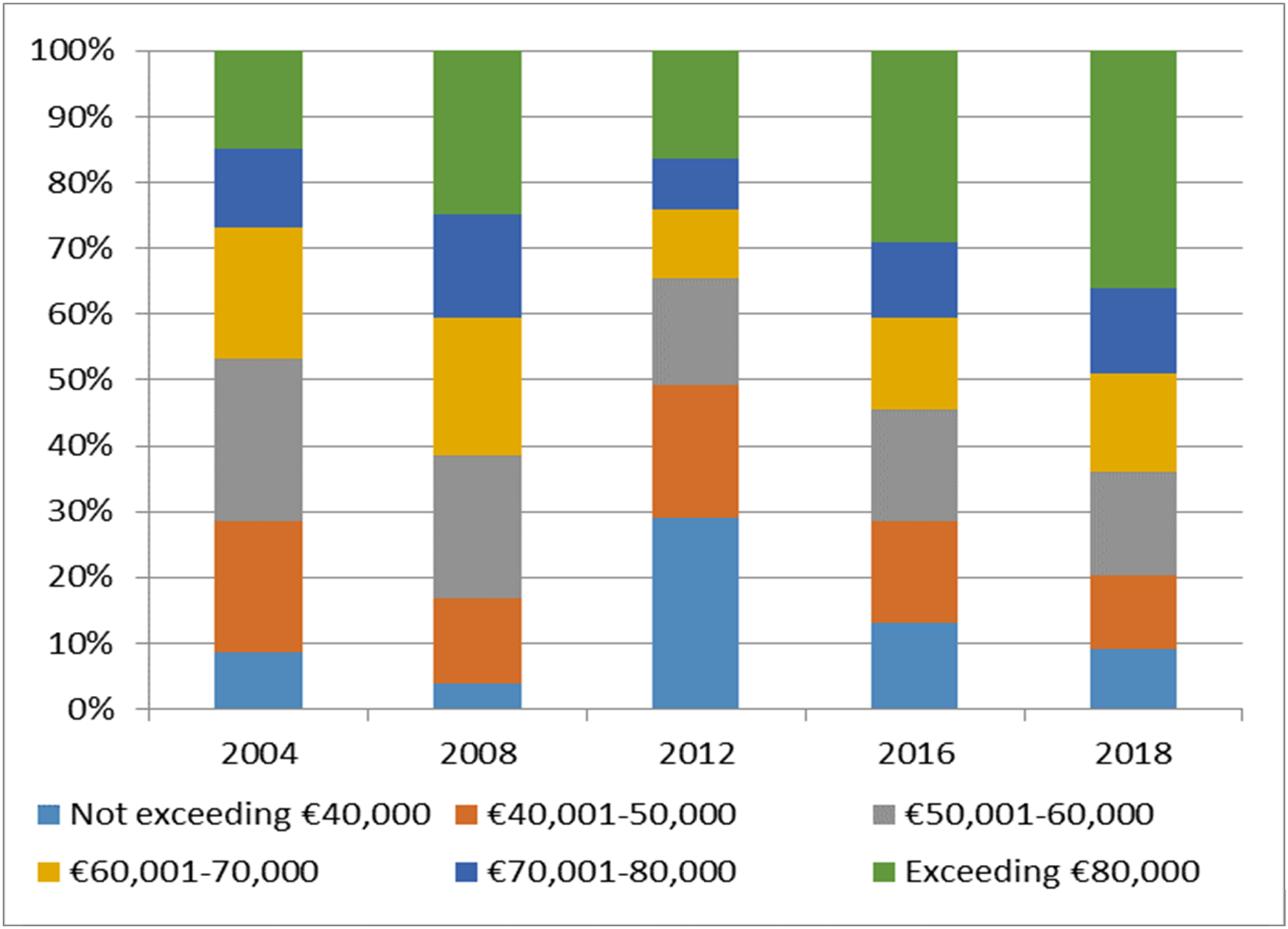

- Whereas First Time Buyers (FTB) with incomes exceeding €80,000 per year accounted for 15% nationally and 27% in Dublin of all FTB mortgages drawn down in 2004, these ratios had risen to 36% and 53% respectively by the end of 2018.

- Whereas 15% of FTB mortgages with incomes exceeding €80,000 were joint drawdowns in 2012 this had increased to around 32% in 2018.

The FTB Mortgages by Borrower Income graph below provides more detail.

BPFI’s Chief Economist, Dr. Ali Ugur, contends that this trend is due to a combination of limited housing supply, high and rising housing costs (including rents) and relatively slower income growth which have made it more difficult for those on low or medium incomes to borrow at current price levels within the restrictions of the Central Bank of Ireland’s macroprudential rules – introduced to enhance the resilience of both borrowers and lenders.

FTB Mortgages by Borrower Income

Sources: Department of Housing, Planning and Local Government (2004,2008), BPFI (2012, 2016, 2018)

It’s not only in the house purchase market that these pressures are evident, according to Dr. Ugur. He points to data from the Residential Tenancies Board and the Central Statistics Office showing that average weekly earnings were able to cover around 94% of monthly rents at the beginning of 2012, but only 65% of average monthly rents nationally by the first quarter of 2019.

Referring to the situation on overall housing supply, Dr Ugur states:

“The mismatch between current demand, as well as pent-up demand, and the supply of new homes seems to have brought average sales prices relatively close to the peak of the previous cycle in terms of sale prices. The same mismatch also seems to be affecting rental accommodation in pushing up private sector rents where we have significantly surpassed peak rents from the previous cycle, notwithstanding the fact that rent increases seem to be stabilising. Meanwhile, average income levels in the economy have not increased to the same extent during the period and affordability in the context of the macroprudential rules seems to be having an effect on demand at price levels at which the construction industry seems able to profitably operate.”

The BPFI Housing Market Monitor is available on the BPFI website here.

Notes: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland and the Fintech & Payments Association of Ireland, BPFI has some 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

The BPFI Housing Marking Monitor is published quarterly. In addition to presenting a unique range of loan-level data, the Monitor draws on a range of published data under the three key headings of housing supply, housing prices and rents, and housing transactions in its assessment of the current state of the housing market.

Contact: Jillian Heffernan, Head of Communications, 087 9016880 or jillian.heffernan@bpfi.ie