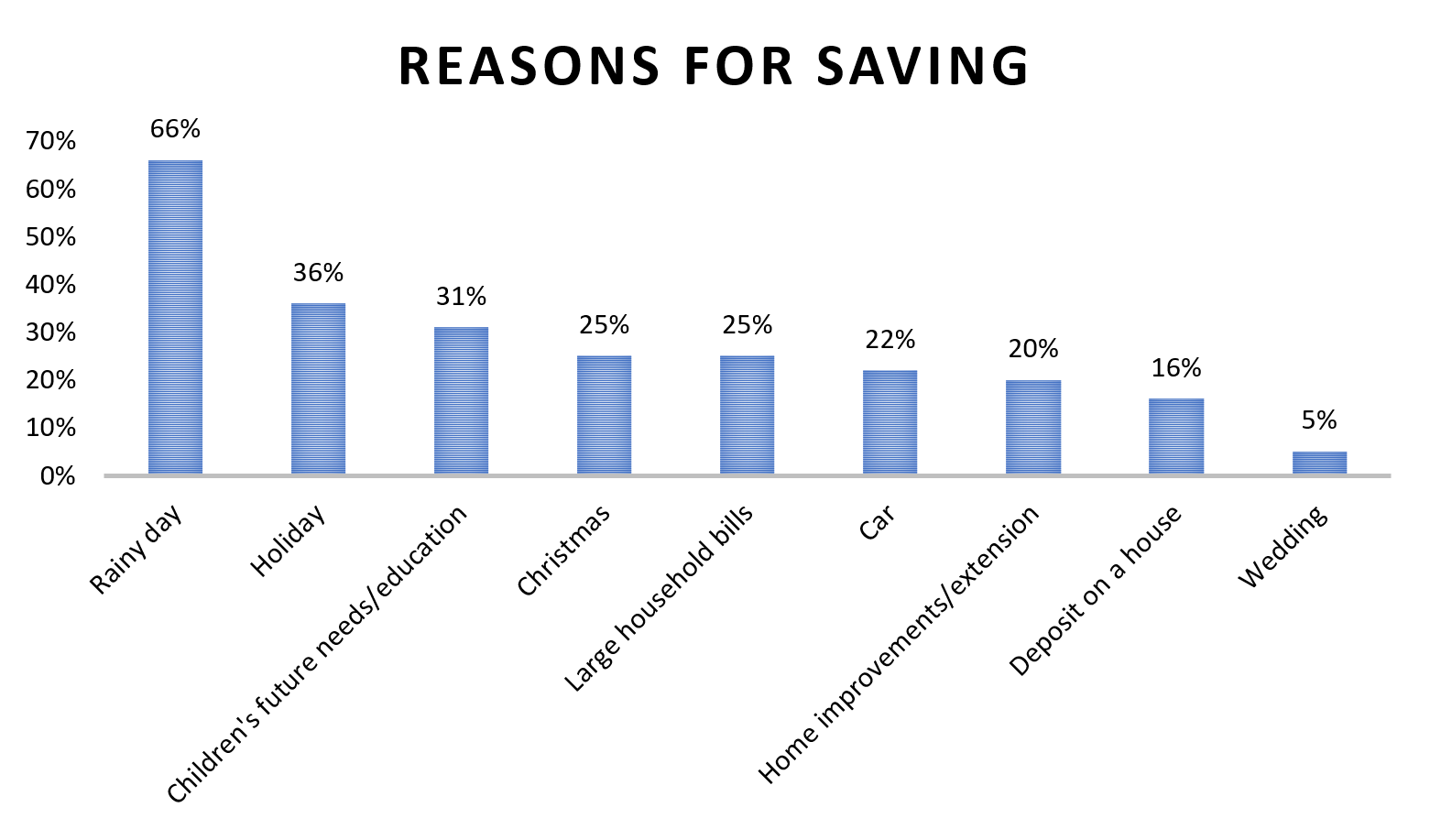

Most savers are putting money away for a rainy day

Higher proportion of those living in Dublin and millennials (25-37 year olds) have savings – 88%

Some four out of five (83%) Irish adults have a bank, credit union or post office savings account, according to a national survey commission by Banking & Payments Federation Ireland (BPFI). Some 46% of adults have a regular savings account, 46% have an account for occasional savings and 18% have a lump sum on deposit.

Among the 17% who do not have a savings account, most (77%) said they did not have money to save. Generation Z (18-24 year olds) were least likely to be saving.

While reasons for saving vary across individuals, two-thirds (66%) of Irish adults say they save for a rainy day, 36% are saving for a holiday, 31% are saving for their children’s future needs or education and a quarter are saving for Christmas or to pay large household bills. (Respondents could select more than one reason for saving.)

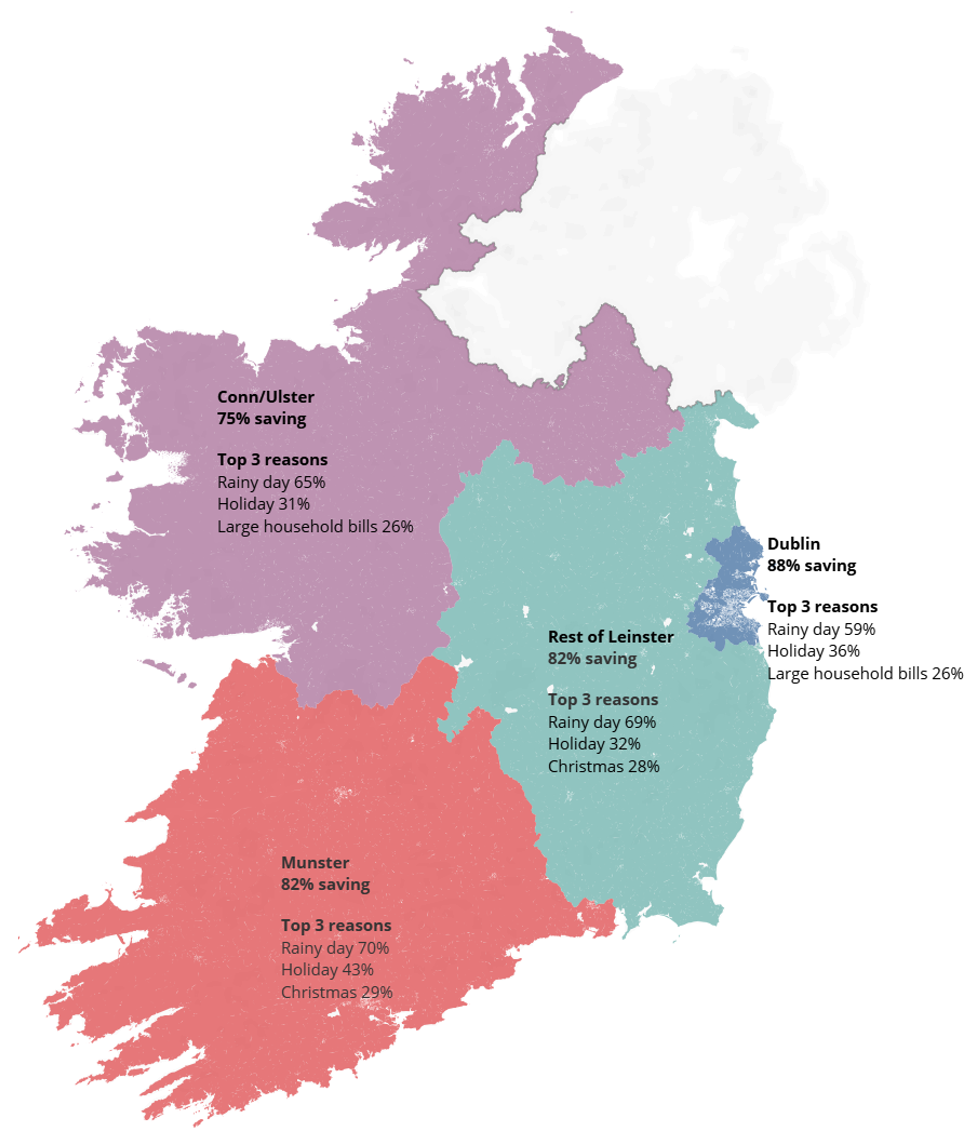

Regional differences

The survey also shows that saving habits vary by age and region. A higher proportion of those living in Dublin (88%) have savings accounts compared to the rest of Leinster (82%), Munster (82%) and Connacht/Ulster (75%). While saving for a rainy day was the main reason cited for saving in most parts of the country, some variation was evident with 59% of those in Dublin saving for a rainy day compared to 69% in the Rest of Leinster, 70% in Munster and 65% in Connacht/Ulster.

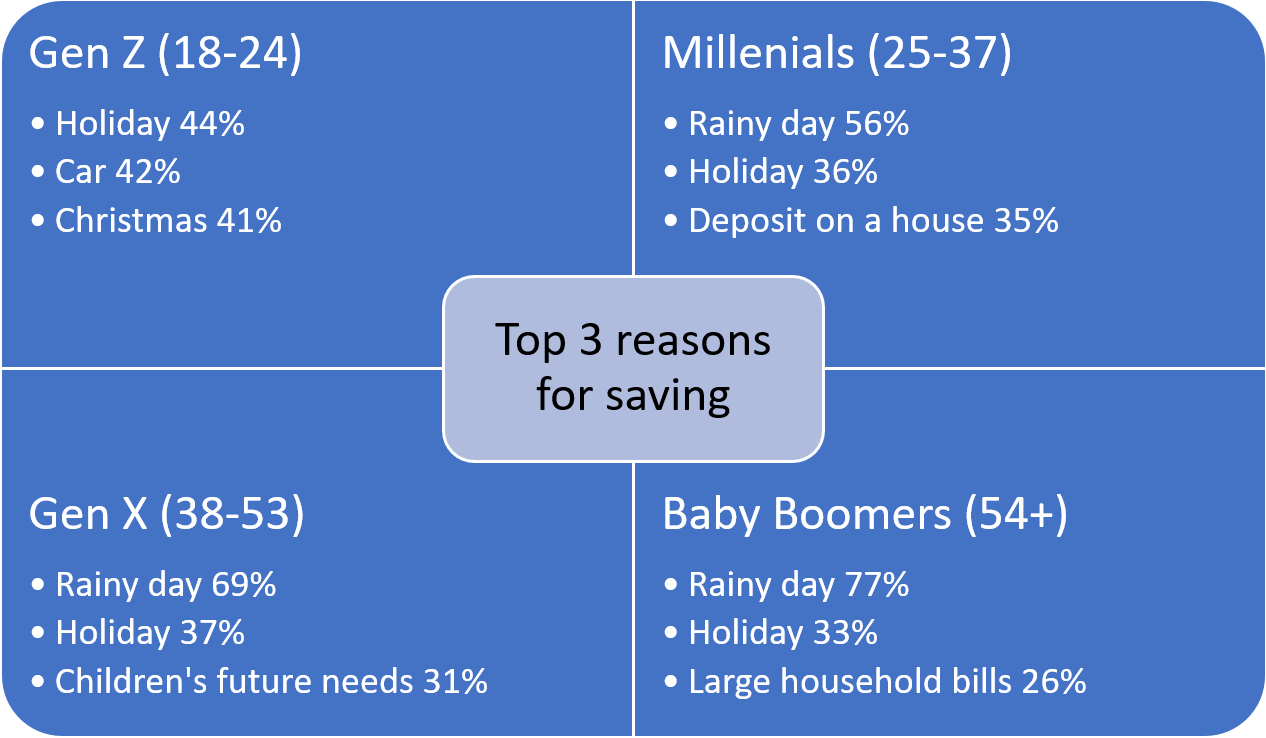

Life stage variations

Variances were also evident in savings habits across different life stages. When asked for the top three reason for saving:

- Generation Z (18-24-year-olds) are focused more on short or medium-term needs such as a car or holidays

- Many millennials (25-37-year-olds) are trying to build up a deposit for a house

- Most Generation Xers (38-53-year-olds) have children so they’re saving for their future needs

- Baby boomers (55+) are most focussed on precautionary savings and planning for big household bills

Speaking about survey results, Brian Hayes, Chief Executive, BPFI said:

“They survey presents some interesting findings both in terms of the age and the geographical differences it highlights. However, essentially it points to the fact that, in the main, Irish adults have developed good savings habits, even at a relatively early age. And even though variances exist in terms of the reasons why people are saving at various stages in their lives, it’s very encouraging to see that rainy day saving is a key priority across most age profiles.”

Editor’s Note: BPFI commissioned Coyne Research to survey a nationally representative sample of 1,000 Irish adults online in October 2019.

Notes: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland and the Fintech & Payments Association of Ireland, BPFI has some 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

Contact: Jillian Heffernan, Head of Communications, 087 9016880 or jillian.heffernan@bpfi.ie