What is a Money Mule?

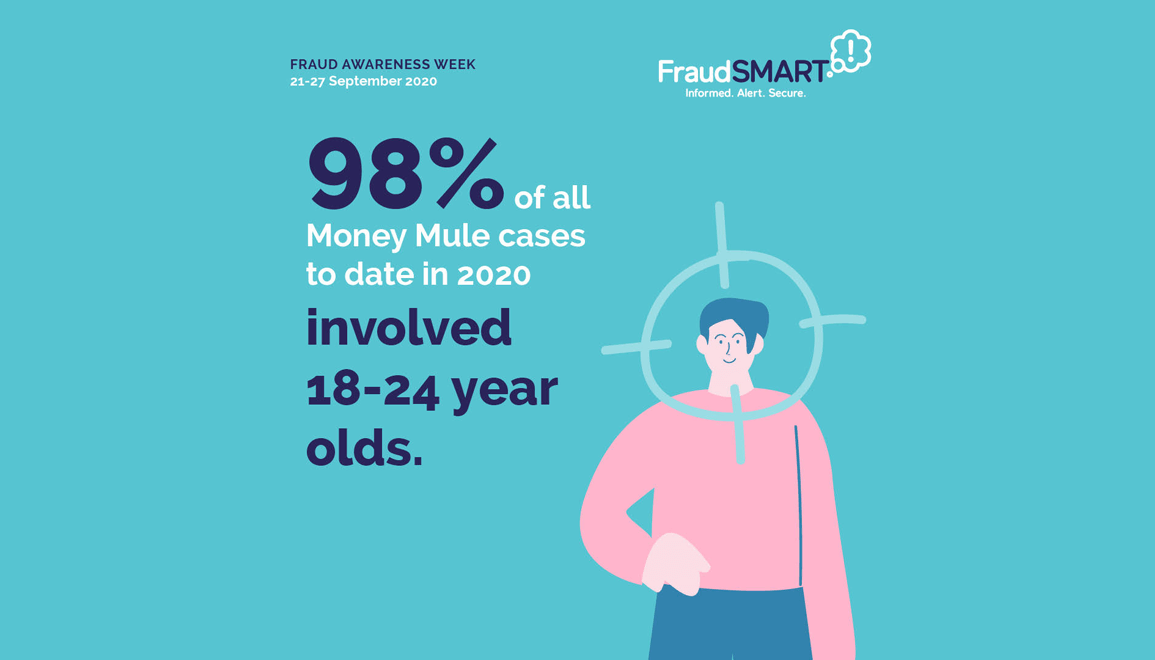

A money mule is a person recruited by criminals to help in transferring stolen or fraudulently obtained money from bank accounts. Money muling equals money laundering.

Criminals pose as employers and dupe targets into laundering money on their behalf. They contact prospective victims with a “job vacancy” advert online, on job search websites or in newspapers. These jobs are usually advertised as “Financial Manager” or “Payments Clerk” with no requirement other than having a bank account. The mule accepts the “job” and in doing so becomes involved in money laundering, which is a criminal activity.

Once recruited a Money Mule receives stolen funds into their account, this is followed by a request to transfer/forward the funds, minus their commission, usually overseas, using a money/wire transfer service. The money the mule is transferring is stolen, and what they are doing is called money laundering, which is illegal.

Recruiting Methods

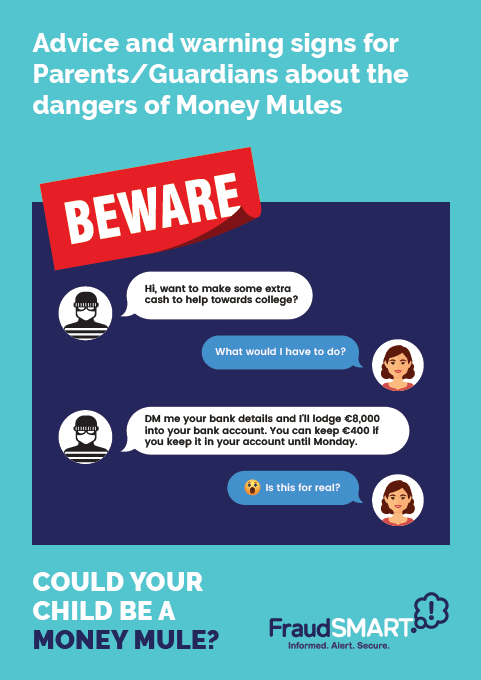

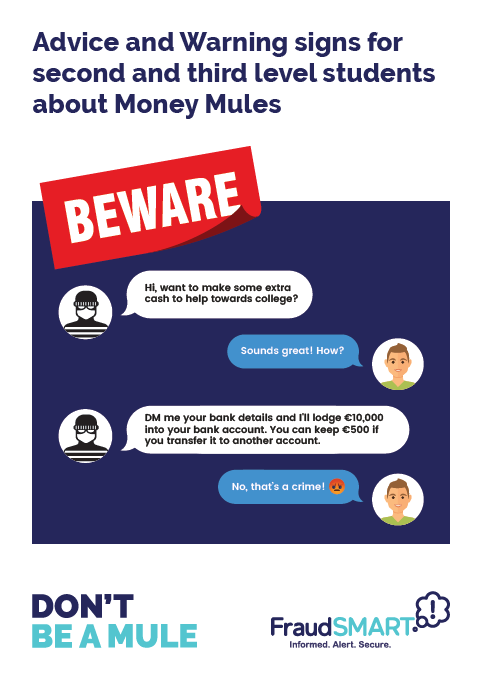

Money Mule scams and the methods by which Money Mules are recruited are constantly evolving as technology advances. Criminals may try to recruit you in a variety of forms and the following means have been frequently used: E-mail, social media messages, fraudulent job ads, fake on-line posts, instant messaging posts/requests and direct communication.

You might be offered a job that involves receiving money into your bank account and transferring it into another account letting you keep some of the cash for yourself. Doing so would make you a Money Mule.

- Be wary of job offers where all the interactions, dealings and transactions are based and done on-line. Do your research about companies before accepting a job or giving out your personal information. Also, double check job offers from people and companies from overseas.

- Conduct thorough background research regarding any company that makes you a job offer. Research any company that makes you a job offer and make sure that their contact details (address, landline phone number, e-mail and website)

are genuine. - Be cautious of unsolicited emails and social media posts and online pop-up ads. Resist the temptation of online ads /social media requests for offers of cash if you allow your bank account to be used to transfer money across the system.

- Be cautious of unsolicited offers of “easy money”, “stress – free get rich quick scheme” or “earn a significant amount of money for minimal effort”. These are invariably fake schemes.

Consequences

- There are severe consequences which can have a lifelong effect.

- Acting as a Money Mule will impact your future opportunities, including future difficulties with your finances. If you are caught acting as a Money Mule, you could possibly be prosecuted and have a criminal record.

- Money Mules that are caught will have their bank accounts closed and are less likely to get a loan or other credit services.

- Former Money Mules who have had their accounts shut down have found it extremely difficult to open new accounts.

Key Advice

- Thoroughly research any work from home opportunities and do not get involved unless you are sure the business is legitimate. Verify any company that makes you a job offer and check their contact details (address, landline phone number, email address and website).

- Be very careful of unsolicited offers or opportunities to make easy money.

- Be especially wary of job offers from people or companies overseas as it will be harder for you to find out if they are legitimate.

- Never give your bank account details to anyone unless you know and trust them.

- Never allow your bank account to be used by someone else.

- If a job sounds too good to be true, then it probably is.