Banking & Payments Federation Ireland (BPFI) has today published the latest figures from the BPFI Mortgage Drawdowns Report for Q2 2019 and Mortgage Approvals Report for June 2019.

The following are the key figures from the Mortgage Drawdowns Report for Q2 2019:

- 10,157 new mortgages to the value of €2,250 million were drawn down by borrowers during the second quarter of 2019

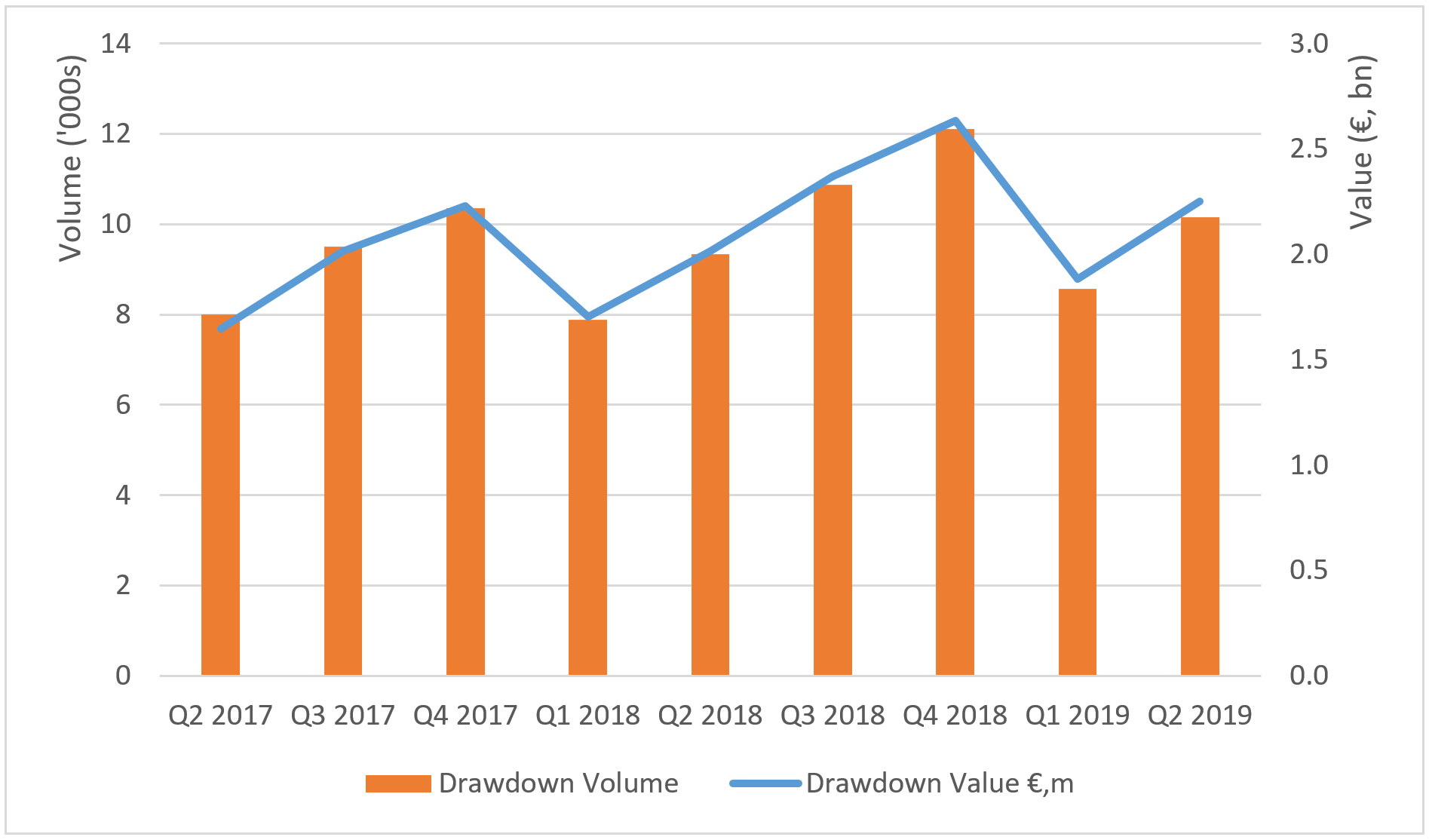

- This represents an increase of 8.8% in volume and 11.7% in value on the corresponding second quarter of 2018. A comparison with the previous quarter (Q1 2019) also shows a strong increase in both volume (18.4%) and in value (19.4%) – see the chart below.

- First-time buyers (FTBs) remain the single largest segment by volume (49.6%) and by value (50.5%).

- Switching activity (re-mortgage loans) also recorded a year-on-year increase of 11.0% in volume and 12.8% in value.

Mortgage Drawdowns Trend, Q1 2017 to Q2 2019

In addition, BPFI also published today the latest figures from the BPFI Mortgage Approvals Report for June 2019. The following are the key elements:

- A total of 4,478 mortgages were approved in June 2019 – some 2,235 were for FTBs (52.1% of total volume) while mover purchasers accounted for 1,233 (27.5%)

- The number of mortgages approved rose by 4.8% year-on-year and fell by 9.1% compared to the previous month.

- Mortgages approved in June 2019 were valued at €1,032 million – of which FTBs accounted for €550 million (53.3%) and €332million by mover purchasers (32.2%).

- The value of mortgage approvals rose by 7.3% year-on-year and fell by 9.2% month-on-month.

Commenting on these latest figures, BPFI’s Director Public Affairs, Felix O’Regan, stated:

“The number and value of mortgages actually drawn down by borrowers during Q2 2019 show good growth on corresponding 2018 activity. This should come as no surprise, as it reflects the growth during the first half of the year in the number of mortgages approved for borrowers by lenders – largely driven by First Time Buyers. The growth in mortgage switching over the last 12 months supports our assessment showing activity in this area returning to a level last seen in 2008. Mortgage approvals in the year to June show good growth at 4.8%, while activity is down on the preceding month of May – which could be down to seasonality.”

The BPFI Mortgage Drawdowns and Mortgage Approvals reports can be viewed on the BPFI website here.

Note: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland and the Fintech & Payments Association of Ireland, BPFI has 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

Contact: Jillian Heffernan, Head of Communications, jillian.heffernan@bpfi.ie 087 9016880