Banking & Payments Federation Ireland (BPFI) has today published the latest figures from the BPFI Mortgage Drawdowns Report for Q1 2019 and Mortgage Approvals Report for March 2019.

The following are the key figures from the Mortgage Drawdowns Report for Q1 2019:

- 8,577 new mortgages to the value of €1,884 million were drawn down by borrowers during the first quarter of 2019

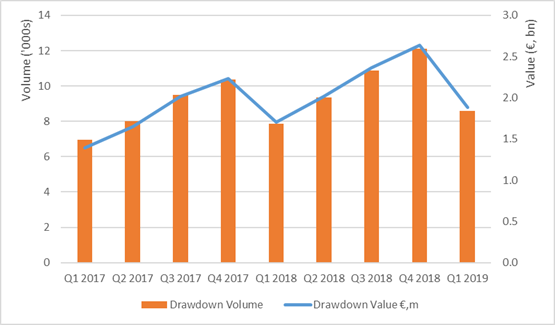

- This represents an increase of 8.9% in volume and 10.6% in value on the corresponding first quarter of 2018. A comparison with the previous quarter (Q4 2018) shows a decrease, but it should be noted that Q1 is typically the weakest quarter in any year and Q4 is the strongest – see the chart below.

- First-time buyers (FTBs) remain the single largest segment by volume (47.3%) and by value (47.9%).

- Switching activity (re-mortgage loans) also recorded a year-on-year increase of 37.0% in volume and 39.3% in value.

Mortgage Drawdowns Trend, Q1 2017 to Q1 2019

In addition BPFI also published today the latest figures from the BPFI Mortgage Approvals Report for March 2019. The following are the key elements:

- A total of 4,142 mortgages were approved in March 2019 – some 2,114 were for FTBs (51.0% of total volume) while mover purchasers accounted for 1,035 (25.0%).

- The number of mortgages approved rose by 22.8% year-on-year and by 23.1% month-on-month.

- Mortgages approved in March 2019 were valued at €920 million – of which FTBs accounted for €473 million (51.4%) and €266 million by mover purchasers (28.9%).

- The value of mortgage approvals rose by 20.7% year-on-year and by 21.6% month-on-month.

- The number of re-mortgage/switching approvals rose strongly both on a year-on-year basis (37.1%) and a month-on-month basis (43.6%).

Commenting on these latest figures, BPFI’s Director Public Affairs, Felix O’Regan, stated:

“The number and value of mortgages actually drawn down by borrowers during Q1 2019 show good growth on corresponding 2018 activity. This reflects the appropriate response by lenders to increased demand for mortgage finance. Furthermore, the uplift in the number and value of mortgages approved in March indicates that further growth in drawdown activity can be expected.”

The BPFI Mortgage Drawdowns and Mortgage Approvals reports can be viewed on the BPFI website here.

Note: Banking & Payments Federation Ireland (BPFI) represents the banking, payments and fintech sector in Ireland. Together with its affiliates, the Federation of International Banks in Ireland and the Fintech & Payments Association of Ireland, BPFI has 100 member institutions and associates, including licensed domestic and foreign banks and institutions operating in the financial marketplace here.

Contact: Jillian Heffernan, Head of Communications, jillian.heffernan@bpfi.ie 087 9016880